Welcome to the constantly updated

White Paper

Scroll to Read

Introduction White Paper v1.0

-

At a high-level, its essential to look at how digital currency relates to central bank issued notes (cash), how a CBDC platform could be linked to the existing payment infrastructure and similarities between value-based and account-based digital currency.

--

A CBDC would be the same as the nation's currency, a store of value from the central bank that can be stored at the central level or locally in accounts, cards or in a mobile app. The digital currency will act like the states national cash and would have the same value as the currency in the form of cash or money in a private bank account. The digital currency would be without liquidity and credit risk. And the central bank would continue to issue the volume of central bank digital currency demanded by the general public, as cash as is the norm today.

---

CBDC would function parallel with cash and be the alternative and complement to cash and payments offered by banks. CBDC platform must be constructed so that banks would be able to instantly exchange money in their accounts for central bank digital currencies. Since the CBDC is digital, this exchange could be made much faster than how it's done with cash today because the CBDC and the central bank account-based payment system are fully interacted.

----

A CBDC platform would provide the opportunity for relatively low-cost payments that digital payments generally involve. A CBDC can be used for a person-to-person transaction, e-commerce transaction, payment at point-of-sale in real-time etc. Payments would be available 24/7/365 and transfers made instantly and settled directly.

-----

Some basic range of services must be produced by the Central bank on the CBDCP to ensure that there are payment services that can be adapted to specific target groups. This is about the broader perspective and the state's role of general inclusion of all individuals and groups. The state cannot expect the private market to cater for full inclusion in the first phase of digitization.

------

Digital central bank currency must be simple and convenient to pay with, as cash is today. It must be a system that could conduct multiple payment services that cater to different environments, individuals, and situations. And it must be possible to choose intuitive and straightforward options for payment that everyone can understand.

-------

It is vital to develop a technical infrastructure for the central bank digital currency platform (CBDCP) so that the FinTech companies and payment service providers that are licensed to operate can join in developing and offering payment services to individuals, households, organizations, merchants and companies.

Introduction White Paper v1.0

Our mission is to even out the playing field for everyone through R&D projects by advocating for platforms and infrastructural development that will ensure every nation’s sovereignty in terms of control and ownership of payment infrastructures. The organization’s advocacy for central bank digital currency will ensure that anyone can be able to settle any payment from anywhere to anyone at any time.

Providing a platform and Central bank digital currency

For the last hundred years, the central bank has had a monopoly on issuing cash. If we continue with the rapid pace cash decline we see in some societies, states will find themselves in a situation where the roles have changed, and all payments the general public have access to is issued and controlled by commercial companies and institutions. Except for the central bank internal system for payments between banks and financial institutions, private ownership would be in control of the entire payment infrastructure and market.

The payments system is evolving very rapidly! The digitization of the financial system has been going on for decades (e.g., dematerialization of financial assets, electronic trading platforms, digital and mobile banking, etc.). So, why shouldn’t cash also become digital? The digital currency could become the equivalent and the alternative to cash in an electronic form, complementing the states monetary policy in offering state-backed physical cash!

Offers risk -free payment alternative as compared to private bank money

It’s important to emphasize that the fourth industrial revolution and Central Bank Digital Currencies (CBDC) has nothing to do with private crypto assets such as bitcoin. The former would be a currency like cash and be governed by the same standards on stability as physical cash, while the latter is not a currency but just an asset not backed by any clear governance, mandate, laws or other assets, and its almost impossible to effectively update improvement of the platform. CBDC would add another payment alternative to the general public, create a digital cash-like alternative that bears no risk compared to private bank money and quasi-monopolistic payment systems. With the present system, central banks might be unable to mitigate several deflation shocks. Thus, central banks should act pro-actively with elected officials and the general public on how to proceed with creating central bank digital currencies (CBDC).

A central bank digital currency (CBDC) can fulfill important societal functions. If the marginalization of cash continues, a CBDC could ensure that the general public still has access to a state-guaranteed means of payment. State presence on the payment market in the form of a CBDC retains the option we have today of being able to convert money in a private bank into state-issued money, which is seen as safeguarding our trust in private money. Alternatively, not to act in the face of current development and completely abandon the payment market to private agents, will mean that the general public will be entirely dependent on private payment solutions, which will make it more difficult for the Central bank to promote a safe and efficient payment system.

Central banks existing systems for large-value payments are starting to become outdated.

If the marginalization of cash continues a digital central bank currency (CBDC), a digital currency, will be the equivalent of how cash functions, giving the general public the same access to a state-guaranteed means of payment, as cash is today.

Central banks have a statutory task to promote a safe and efficient payment system. Increased digitalization means that the use of cash will decline. Developments in the field are always in a change, and within a decade, if the current trend in the high-tech FinTech penetrated areas continue to spread around the world, we can find ourselves in a situation where cash is no longer generally accepted as a means of payment. Due to that, cash will be too expensive to accept, and digitalize. New technology has brought up some critical questions for the central bank’s responsibility towards the general public. The central banks around the world are in discussion with elected politicians on how to react to the changing innovations that are happening in the payments sector. Will the Central bank pass responsibility for payments to the private sector, or will they continue to supply a payment alternative to the general public with issuing a digital central bank currency?

The core decision for the state is, whether they have the intention to give the general public continued access to a risk-free means of payment in the future. And will a digital currency increase flexibility in the payment system and make digital payment available to individuals that find technology challenging to adopt to?

A central bank issued digital currency will have the same claim on the central bank in the same way as physical issued cash. The digital currency will be available to the general public 24/7/365 and can be used to make instant payments at any point in time. It can be offered initially as non-interest-bearing and gives the public access to central bank money even when physical cash is not available. Central bank digital currency (CBDC) can either be an account or value-based units that can for instance be stored locally on a card or in an app.

If the central banks around the world do not decide to act in the face of current developments and choose to leave the payment market to be developed by private payment corporations and private banks, the central bank inactivity in this critical time of change leaves the people entirely dependent on corporations and privately owned payment solutions. Which again ultimately make it difficult for the Central bank to promote a safe and efficient payment system for the general public. As society continues to adopt electronic payments, it will no longer be profitable for merchants to accept cash in the future. If the trend continues in this ever-accelerating phase, some countries may find themselves in a position where cash is no longer generally accepted by people and retailers in the next decade. Cash has been the central banks offer to the public as a means of confidence to facilitated trade in goods and services. The new and changing digital payment market we’re now heading towards means that all payment available to the general public could be controlled by private corporations and organizations, if the central bank, mandated by the state, do not have a payment solution to offer the general public as an alternative to the few private solutions that will corner the market in the future. This decision can lead to a stop in innovation, development, and free competition. So, what the state ends up with is an unstable payment eco-system, at the risk of undermining confidence in the countries whole monetary system. These problems will be balanced or reduced by issuing a central bank digital currency (CBDC) to the general public.

What can a Central Bank Digital Currency provide?

The digital currency could become and be the alternative to cash in electronic form, and as a complement to existing physical cash. The private market cannot be expected to take all the responsibility for ensuring that payments function in times of crisis as such the general public will have access to digital central bank backed money and the states will have the ability to maneuver payments in major crisis situation. A CBDC will be an alternative system to the private one, and thereby give stability in the national payment system.

A state-backed CBDC platform could offer an open and neutral architecture infrastructure which private payment service providers, FinTechs, Banks, and licensed financial companies can join if they wish to provide services to individuals, households, and companies. An open platform will boost the nation’s innovation, reduce the fees charged to the general public, and increase competition.

As digital payment solutions integrate itself in society, there will be groups in the population that will face challenges when physical cash will not be accepted in all aspects of everyday life. This could be people with disabilities or elderly people who find it problematic to use private companies’ digital payment solutions, for one reason or another. This group of people will end up without the ability and access to payment options. The government cannot expect that the private payment companies will incorporate features to explicitly help these groups. The option is that the state CBDC system can develop specific and user-friendly designed payment applications for some groups in society, or use legislation and regulation to enforce private payment companies to take responsibility.

Should the Central Bank Digital Currency be value-based or account-based?

A digital currency can be characterized as a country’s currency that can be stored locally or kept in an account (value-based) or at the central bank (account-based). Value-based are typically stored in a card or a mobile payment app. Either way an account-based or value-based digital currency, must have an underlying ledger to both alternatives to keep track of transactions and encryption. The result is that all digital transactions and digital asset are traceable.

For the CBDC to act like cash, it must be possible to make physical purchases in a store as well as online. The digital currency platform that is the core protocol must be built to interact with an unlimited number of other systems, financial institutions, and banks. Companies need to be able to join the Central Bank Digital Currency platform in order to innovate, develop, and offer payment services to individuals, organizations, and companies. The platform needs to have well-built and integrated basic features to enable the digital currency to easily move in and out of the platform. Anti-money laundering (AML), Know your customer (KYC), and anti-corruption (AM) function should also be a part of the system. Also worth considering is the option to provide a standard underlying back-office architecture for the financial institutions that will be joining the CBDC platform.

Legally speaking, a value-based digital currency is classed as e-money in most jurisdictions, while an account-based digital currency will be linked to a deposit.

One option to offer a digital central bank currency that will act as cash could be to offer it in the same way as most central banknotes or cash is offered in the society today, widely available to all people, households, organizations, and companies regardless of country of origin and domicile.

The demand for a central bank digital currency outlines the ramification for financial stability and monetary policy.

How financial stability and monetary policy will be affected by a CBDC, depends on how much demand for the digital currency will be. Demand will depend on how the CBDC, and platform are designed, and how easy it is for people and companies to join.

The effects on the financial system will be insignificant if the demand is low. Consequently, some banks receive fewer deposits, which lead to the need for some extra funding. As opposed to the current traditional system of banking, the digital currency will make the transit from the banking system to state-guaranteed money both quicker and safer in times of financial unease, when people want to withdraw their assets from weak banks. Most central banks already have the means to handle this kind of situation, but the digital currency will make the system more efficient and unnecessarily burdensome for the holder of this digital currency.

Coding the CBDC platform as account-based or value-based does not complicate the technical build. However, the Central Banks has a statutory task to promote an efficient and safe payment system; this has been done by supplying the general public with physical money for the past hundred years. So, why shouldn’t the central bank issue digital money in the future?

The demand for physical money is stable, and the demand for electronic payments is increasing all around the world.

High demand for cash in some countries can be explained by its function as a safe store of value and lack of trust in existing value-based systems. In digital oriented and developed countries, cash in circulation as a percentage of GDP is continuing its downward trend. In countries which have a high penetration of trust and functional FinTech solutions serving the general public, we can see that the value of cash in circulation has dropped to half, and that’s even after the financial crisis of 2008.

How does the payment market look in those countries where cash in circulation is at its highest downward trend?

The Nordic countries are currently a pioneer in regard to digital developments. The Bank-ID apps that enable simple and instant identification have been an enabler and a reason why Scandinavians have been able to adapt relatively quick. In Sweden, local companies are able through their legislation to waive payment in cash if they provide customers with information that they do not accept cash payment.

Cash has not been made more difficult to get hold of in the high digital penetrated markets, ATMs have been just as many since 2008, but the general public’s withdrawal amount is also declining, a good Indicator that digital payment solutions can be perceived as more easily accessible and convenient use as a means of payment. Even though Swedish legislation gives the merchant the option to refuse to accept cash, it’s never a problem paying in cash in local shops at this time.

What happens when development spiral towards lower acceptance for cash, and when problems in paying with cash are not accepted, due to the costs incurred by the receiver? When only a few consumers pay in cash, then it stops being profitable to accept.

An important decision for central banks to produce a CBDC for the general public hinges on whether this development in declining cash use and acceptance is primarily due to consumers and merchants becoming uninterested in using cash. If so, the trend will not be broken just because the central bank stimulates access to more cash, by increasing or maintaining supply.

In every country there will be groups or individuals that have difficulties in getting access to payment accounts for various reasons.

In EU and most of developing countries around the world, legislation state that those who are resident within the state have the right to open a payment account, if there exists no special reason to deny them this service. When Cash declines and no longer will be a generally accepted means for payment, the state runs the risk that some groups and individuals will find themselves in a situation where they have difficulties in getting paid and paying for product and services.

Commercial actors will always be the largest developers in the payment market. The private business side of the market target their products to maximize their service and profit. How the state distinguishes themselves from the commercial side of the market is to have a social perspective that will benefit society.

Without a state presence, the new digital market may result in a monopolistic market controlled by a few, where product supply will target most of the public, but not all. So, in the end, service may become too expensive for some groups in society.

The general public can be affected if the Central Bank does not react to the developments in the payment market! The fundamental trust in the states monetary policy system can risk declining when cash is marginalized, and when the knowledge that money in the bank account can no longer be converted to risk-free state money in the form of cash, since cash might not be a general means of payment in a possible future scenario. CBDCs will be a reasonable solution, not only in times of financial unease, with the knowledge that at any time money in a bank or financial institutions account can be converted to a state-backed Central Bank Digital Currency. This will give the general public the same trust they have in cash today.

Is the money people have in their bank account different from the Central bank money?

The most important difference is whom you have a claim on!

Central banks and the state have a stability target to safeguard the value of money over time, and therefore have a lower liquidity and credit risk than private bank money. This is to preserve confidence in both the private bank and central bank money.

Individuals and companies as customers in a bank have a claim on the bank (“private incorporation company with a bank license”), and with central bank money you have a claim on the state. Private banks can go bankrupt. Placing funds in a bank account have some risks. Central banks have unlimited capacity to produce new money and can always meet their commitment to the account holder, it’s the significant credit and liquidity risk between the two. Central bank money is a risk-free asset and a means of payment.

Bank money comes with deposit guarantee function, it can be considered risk-free only up to a certain amount. Private money is made safe by state deposit guarantee and legislation. It’s not the same as central bank money. To activate private bank state deposit guarantee money takes time. Thus, private bank money is not as liquid or reliant as central bank money.

When financial institutions settle payments between themselves, they usually prefer to use their holdings in the central bank. Central bank settlement gives financial institutions money in a risk-free and on a neutral part account system.

Central banks task to promote confidence in the payment system and money for the general public

Should cash usage disappear in future, the relevant question for the state and the central bank arises, whether it is only credit and financial institutions that should have unlimited access to risk-free central bank money, and not the general public.

In most modern monetary systems, the state’s priority is to give the general public faith in the local currency, regardless of whether its private bank money or central bank money. Since most new money is generated by banks, and there is only deposit guarantees on some of that money, trust issues in local currency are bound to arise in times of financial unease. Since bank`s is no longer obligated to hold central bank notes equal to their own private money owing to various forms of regulation, trust in the banking system as a whole fails.

When there is no possible way to exchange into central bank money, and the general public or businesses only alternative is to move money from one bank to another, faith in the local currency and system could collapse.

A Central Bank Digital Currency and a payment market in transformation.

The digital central bank digital currency will be an instant compliment to cash and most likely become a potential future platform for instant settlement for all. CBDCs would give the general public the possibility to hold central bank risk-free money. And CBDCs would offer what cash is doing, i.e., enabling the general public to make instant payments and withdrawals from banks and financial institutions, at their discretion in times of instability, making it an instant settlement of payment between accounts.

The states national focus on a payment system will of course be affected by development from the world around it. That’s why a central bank digital currency platform (CBDCP) infrastructure and service must shift from the typical national overview to a more cross-border one. Collaboration will lead to network effect and economies of scale. In the long run, national market will be too small for these effects to be fully utilized.

National infrastructure, or a joint cross-border CBDC platform.

Creating a national payment infrastructure with common products for instant settlement between bank accounts, or a cross-border multi-digital currency system for instant settlement between all banks and central banks, should be built on some of the same truth and trust principles from back in the 19th century, when private banks were obligated to hold central bank notes equal to their own banknotes for instant external exchange.

Joint cross-border infrastructure for instant payment should have the capacity to hold, and instantly settle any payments, in any currency between private banks and their customers’ accounts.

The development towards instant settlement payment will continue.

The general notion is that if a central bank would offer such a system, it would not necessarily have to be operated by the central bank, or even be located in their country. This will duly enable a joint cross-border central bank platform to exist and provide instant settlement in national currency on a cross-border infrastructure.

For the last hundred years, the central bank has had a monopoly on issuing cash. If we continue with the rapid pace cash decline, we see in some societies, states will find themselves in a situation where the roles have changed, and all payments the general public have access to is issued and controlled by commercial companies and institutions. Except for the central bank internal system for payments between banks and financial institutions, private ownership would be in control of the entire payment infrastructure and market.

How a CBDC project could be designed.

At a high-level, its essential to look at how digital currency relates to central bank issued notes (cash), how a CBDC platform could be linked to the existing payment infrastructure and similarities between value-based and account-based digital currency.

A CBDC would be the same as the nation’s currency, a store of value from the central bank that can be stored at the central level or locally in accounts, cards or in a mobile app. The digital currency will act like the states national cash and would have the same value as the currency in the form of cash or money in a private bank account. The digital currency would be without liquidity and credit risk. And the central bank would continue to issue the volume of central bank digital currency demanded by the general public, as cash as is the norm today.

CBDC would function parallel with cash and be the alternative and complement to cash and payments offered by banks. CBDC platform must be constructed so that banks would be able to instantly exchange money in their accounts for central bank digital currencies. Since the CBDC is digital, this exchange could be made much faster than how it’s done with cash today because the CBDC and the central bank account-based payment system are fully interacted.

A CBDC platform would provide the opportunity for relatively low-cost payments that digital payments generally involve. A CBDC can be used for a person-to-person transaction, e-commerce transaction, payment at point-of-sale in real-time etc. Payments would be available 24/7/365 and transfers made instantly and settled directly.

Some basic range of services must be produced by the Central bank on the CBDCP to ensure that there are payment services that can be adapted to specific target groups. This is about the broader perspective and the state’s role of general inclusion of all individuals and groups. The state cannot expect the private market to cater for full inclusion in the first phase of digitization.

Digital central bank currency must be simple and convenient to pay with, as cash is today. It must be a system that could conduct multiple payment services that cater to different environments, individuals, and situations. And it must be possible to choose intuitive and straightforward options for payment that everyone can understand.

It is vital to develop a technical infrastructure for the central bank digital currency platform (CBDCP) so that the FinTech companies and payment service providers that are licensed to operate can join in developing and offering payment services to individuals, households, organizations, merchants and companies.

Cash anonymity option and CBDC traceability

Cash offers the possibility to make payment anonymously without identifying oneself when paying, in contrast to card payments that could enable even an anonymous payment to be traced. Digital payment leaves a traceable digital footprint, in the form of digital wallets, encryption keys, and time of payment. However, anonymity must not be confused for fraudulent behavior; it is just a transaction without third-party transparency. CBDCs can to some extent mimic the anonymity of cash if needed with the use of zero-knowledge proofs and a whole range of other cryptographical solutions on the protocol level. The CBDCP keeps track of all records, but it’s not always wise to expose private payment details to everyone one interacts with, this is one of the options cash has today, and an option Central bank would have to consider to be integrated into a digital currency payment solution.

A Central Bank Digital Currency Platform that is Value-based, account-based, or both options?

The Central bank can decide on two different types of CBDCs that can either be account-based or value-based. Similarities and differences between these two are: account based CBDC is in the form of balance and money in the central banks’ register system. Payment is recorded similar to the way transactions between financial institutions and how private banks are done by the central banks today. A value-based CBDC can be stored locally and is a prepaid value that can be stored in a wallet, on a card or in an app. For the general public, the practical user perspectives of the two types CBDCs will almost be the same, just different underlying CBDCP processes and defined framework that the user will not be affected by.

The CBDC framework should be designed in such a way that in case of failure in network services in communication, payment should be able to be executed offline between different users. The central bank will have to set up a framework that defines how large an amount can be paid, how many in a particular time, and how risk will be divided between the two parts.

Holding an account-based or a value-based CBDC will be different since it will fall under separate legislation.

Value-based digital money falls under e-money directives, and it’s in most jurisdictions not possible to pay interest on e-money. However, there is a possibility to pay interest on an account-based CBDC since it’s not the same legal framework for deposited e-money. An account-based CBDC will fall under the same deposit framework as money in private bank accounts.

If a central bank decides on a multi-option CBDC approach, different options can be made available to meet the need of the general public.

The account-based CBDC can be produced to function something similar to deposits. The individual or company is registered; there are no limits on amounts, value, or types of digital currencies one can hold on an account, app, or card.

The value-based CBDC can be on the other end of the scale and mimic more cash-like functions in its first phase of digitization, but with traceability. A prepaid downloaded value has a relatively low-value limit and can be purchased without showing identification, much like how a prepaid Visa and MasterCard function today.

When the central bank (CBCS) has a clear understanding of how their CBDC should function, there are no different challenges to produce a Value-based or account-based CBDCP.

Payment with both account-based and value-based will have central registration for keeping the ledger of transactions and accounts, which in reality makes all digital transactions registered and traceable in all cases. With the exception like, if prepaid gift cards are made available and given from one person to another the transaction is untraceable, but the spending of the CBDC on the card is in the end traceable. In the end, it would be able to analyze CBDC payments to identify sender and receiver just like other digital payment processing. The same way bank cards are used today, perhaps a little better if the central bank needs extra functionality to be integrated. Account-based CBDC under most state legislation requires an owner register to keep track of who is the owner of the account. In an account-based system, there are records keeping track of who is the lawful owner of the fund sent and received, to ensure that the rightful owner of funds can be accredited. This means that it can be with certainty that disbursement of funds reaches the right account, person or company.

A comparison to see what properties of the two types of central bank digital currency can hold.

Possible properties | Value-based | Account-based |

|

| |

Instant payments | Yes | Yes |

Underlying register | Yes | Yes |

Legal form | E-money (prepaid value) | Deposit (account balance) |

Interest | No, not as a rule | Yes |

Anonymous payments | Yes (below EUR 250) | No |

Traceability | Yes (but not that good if, for instance, a prepaid card changes owner person-to-person) | Yes |

Offline payments | Yes | Yes |

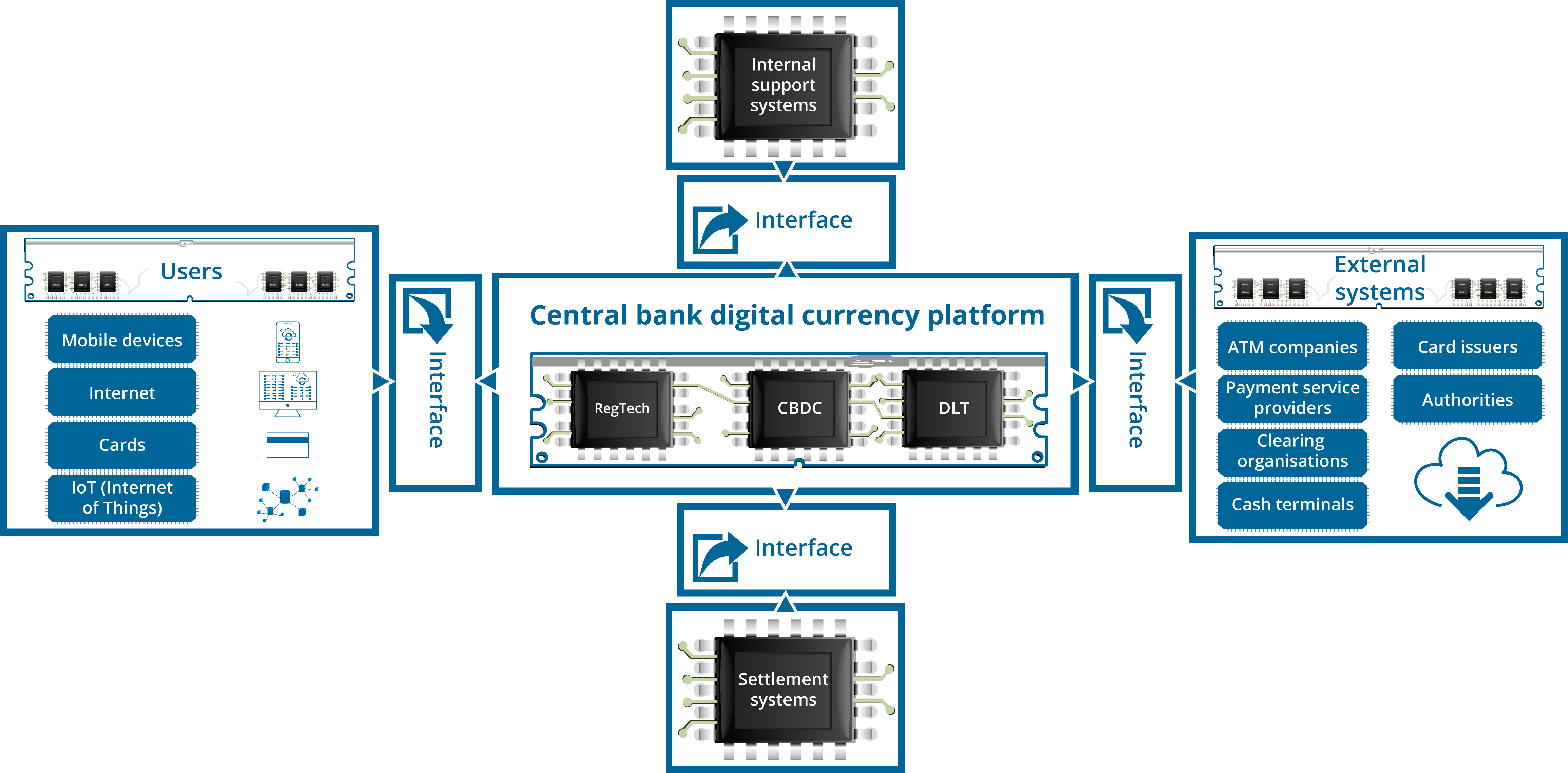

How could a Central Bank Digital Currency Platform look like?

The platform needs to interact with other types of systems and applications, both internal and external. The Central bank should build an open platform containing internal settlement systems, account structure for account-based CBDCs, and value-based register functions enabling redemption of Value-based CBDCs. Those basic applications need to be onboard before a release to the public, and before FinTechs and payment processors can start to develop innovative ways to serve households and companies.

A simple high-level overview of a core CBDC platform

The platform contains the central register for holders of central bank digital currency, regulatory framework, and conditions. The platform must have the necessary logic to implement and process different types of payment. The CBDC platform is the central part of the digital currency system that manages all connections with external and internal systems and participants. The Central bank will own the regulatory framework, and in case of a joint cross-border platform, all participants could control their part of the platform that runs their respective CBDCs. It`s at this protocol level the payment between CBDC users will be finalized.

Application & user

For the general public and companies to be able to use CBDC applications, value-facilitators must be used to complete transactions, e.g., payment cards, payment apps, online bank to bank transfer, and so on and so forth. This can also be done through interaction with hardware that is software enabled and has a built-in smart function, also known as the internet of things. By maintaining an open infrastructure, the central bank does not need to supply companies and households with CBDCs. All developing and service companies joining the platform will take care of CBDC distribution.

External systems

The design of the platform which external systems need to be allowed to connect to is something the central bank needs to determine by the scope of the platform. If the CBDC will offer services via a card, the CBDCP needs to be able to communicate to the underlying card infrastructure. In the case CBDC will be possible to use in ATMs, communication needs to be connected to the companies that offer these services. Companies with the license to supply payment service will also need a connection. If companies, organizations, agents want to use the CBDC to pay into holders of CBDC account, they also need connections. When individuals, households, and companies want to pay their bills in CBDC to giro accounts, the CBDC platform needs to have connections to the clearing organizations that manage those specific payment types.

Internal support systems

The CBDC platform needs administrative and control functions in the form of internal support systems. These types of features are those standard systems available in the bank system today: AML systems to carry out money laundering and anti-terrorist financing, KYC-know your customer control systems, support and certificated system, notification and communication system, statistic and reporting, internal anti-corruption system, authentication and ID systems, and the list can go on and on. Start with basic features, to begin with, and keep on upgrading and developing as the platform usage grows is the way forward.

Settlement systems

The CBDC platform needs to have a connection to the central bank settlement system. The CBDC needs to be linked to central bank money for safe and friction-free flow of CBDCs to move in and out of the platform. This means that the platform must have an instant settlement element in central bank money. A payment that is done from the CBDC platform to a private bank account or from a private bank account to the CBDC platform will be settled between the central bank and the respective banks in one of those two systems.

To summarize

A central bank digital currency can be characterized as any central bank issued currency. The central bank digital currency should always be exchangeable for other forms of central bank currency, whether its cash of central bank account-based money. The CBDC should be broadly accessible to all members of society. Either in the form of prepaid value or an account based. By offering a basic range of services and opening the platform and infrastructure where other participants can create and innovate new and better payment services to offer the general public, the central bank does not need to supply the CBDCs to individuals, households or companies. There are several parallels between an account-based CBDC and a value-based CBDC, but both can be made available in the same technical system. Both systems require underlying ledger and register systems, where every transaction has traceability abilities, even with anonymous payments. To enable the CBDC to be used in practice, it is necessary to make connections to a wide variety of other internal and external systems and participants, and it’s mandatory to make the CBDC instant exchangeable for other central bank money.

General legal prerequisites for issuing CBDC

A possible introduction of central bank digital currency will raise some important questions that require careful consideration.

In most jurisdictions, the assessment is that a CBDC is compatible with the central bank’s statutory task to promote a safe and efficient payment system.

However, the design of the CBDC will to some extent affect the states Central Bank Act, and in some states the central banks Act needs to be amended before a CBDC is released to the public, and therefore the question of issuing a CBDC is up to the legislator.

Some general legal differences between an account-based and a value-based central bank digital currency, interest rate setting, accessibility, and anonymity, that could affect the design of a central bank digital currency.

Please note that the living white paper presented here are for informational purposes only and are based on proposed concepts that may be subject to change, -as our research and development keep progressing.